W2's

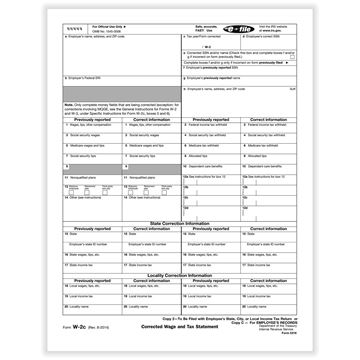

Parts Description W2 Forms

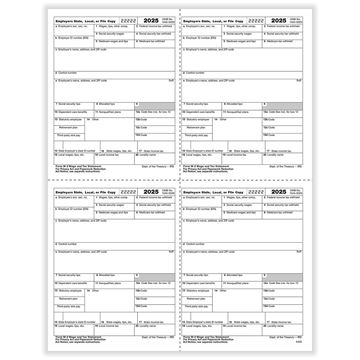

EMPLOYER'S COPIES

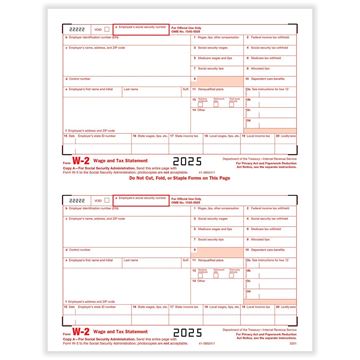

Copy A: For Social Security Administration

Copy 1: For State, City, or Local Tax Department

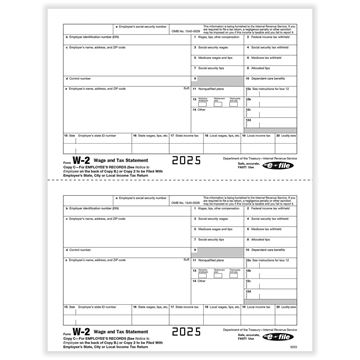

Copy D: For Employer's Records

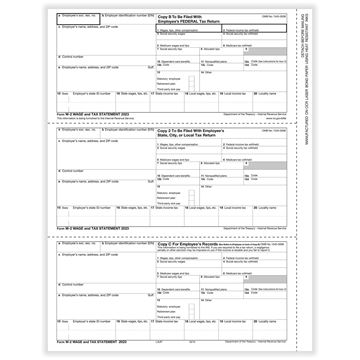

EMPLOYEE'S COPIES

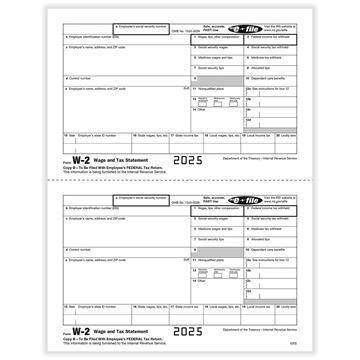

Copy B: To be filed with Employee's Federal Tax Return

Copy C: For Employee's Records

Copy 2: To be filed with Employee's State, City or Local Income Tax Return

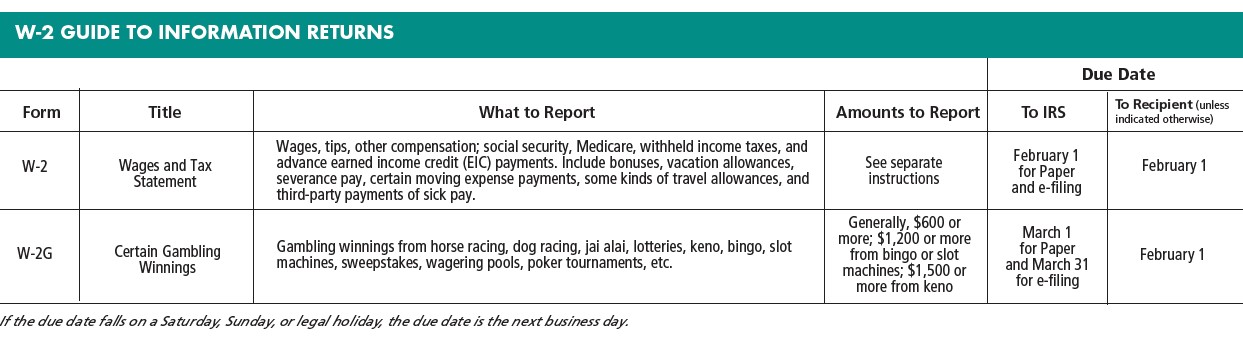

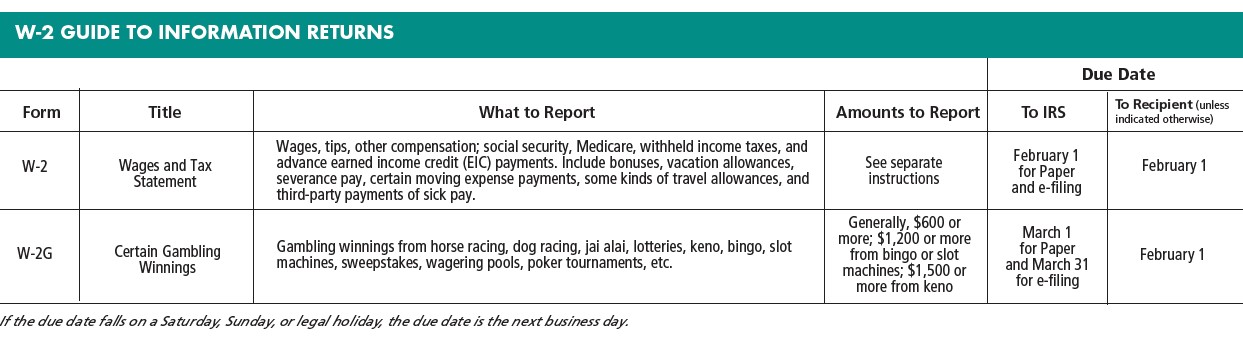

W-2 GUIDE TO INFORMATION RETURNS

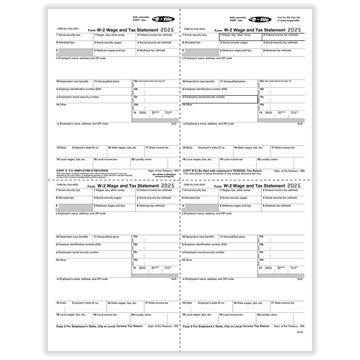

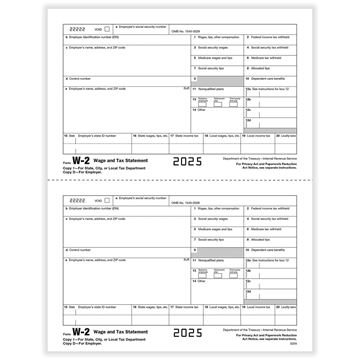

OUR BASIC W2 FORM IRS FORMAT

Each sheet contains information for two employees. All copies are printed separately and the employee copies must be collated for envelope insertion. Forms are sold in packages of 50 8-1/2" x 11" sheets yielding 100 individual W2 forms. Bulk packages of 500 sheets yielding 1,000 forms are available.

W2 BLANK FORMS FOR YOUR SOFTWARE

Blank forms are available for use with software and feature perforations depending on how your software outputs the data. Blank forms are available with or without Copy B, Copy C, and Copy

2 backer information.

ALL FORMS HAVE BEEN OFFICIALLY APPROVED

We work closely with government agencies to ensure that we offer the most complete and compliant line of forms available in the industry today. All forms meet rigid IRS and SSA printing standards in order to pass their OCR (Optical Character Recognition) requirements. All changes and updates have been made and new forms added. In addition, all form have been approved by the Federal Government as well as State and City Tax Agencies.

Parts Description W2 Forms

EMPLOYER'S COPIES

Copy A: For Social Security Administration

Copy 1: For State, City, or Local Tax Department

Copy D: For Employer's Records

EMPLOYEE'S COPIES

Copy B: To be filed with Employee's Federal Tax Return

Copy C: For Employee's Records

Copy 2: To be filed with Employee's State, City or Local Income Tax Return

W-2 GUIDE TO INFORMATION RETURNS

OUR BASIC W2 FORM IRS FORMAT

Each sheet contains information for two employees. All copies are printed separately and the employee copies must be collated for envelope insertion. Forms are sold in packages of 50 8-1/2" x 11" sheets yielding 100 individual W2 forms. Bulk packages of 500 sheets yielding 1,000 forms are available.

W2 BLANK FORMS FOR YOUR SOFTWARE

Blank forms are available for use with software and feature perforations depending on how your software outputs the data. Blank forms are available with or without Copy B, Copy C, and Copy

2 backer information.

ALL FORMS HAVE BEEN OFFICIALLY APPROVED

We work closely with government agencies to ensure that we offer the most complete and compliant line of forms available in the industry today. All forms meet rigid IRS and SSA printing standards in order to pass their OCR (Optical Character Recognition) requirements. All changes and updates have been made and new forms added. In addition, all form have been approved by the Federal Government as well as State and City Tax Agencies.