Miscellaneous Forms

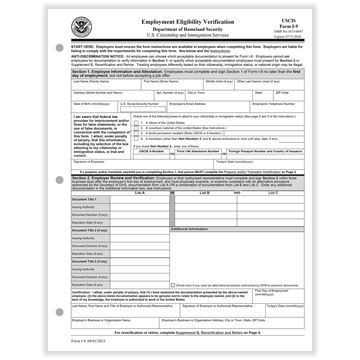

I-9 EMPLOYMENT ELIGIBILITY VERIFICATION

The Department of Homeland Security: Requires employers to use this form to document that each new employee (both citizens and noncitizens) hired after November 6, 1986, is authorized to work in the United States. This form must be completed no later than the time of hire, which is the actual beginning of employment. Both employer and employee are required to fill in information to complete an I-9 form.

W9 PAYER’S REQUEST FOR TAXPAYER IDENTIFICATION NUMBER

Form W9 is used by payers required to file information returns (for example – income paid, real estate transactions, mortgage interest, acquisition or abandonment of secured property, cancellation of debt, or contributions made to an IRA) with the IRS to get the payee’s correct Taxpayer Identification Number (TIN). Payees use Form W9 to give their correct TIN to the person requesting it and, when applicable to:

1. Certify the TIN given is correct,

2. Certify payee is not subject to backup withholding, or

3. Claim exemption from backup withholding. For more information on backup withholding and requirements, obtain IRS Pub. 1679 “A Guide to Backup Withholding,” or Pub. 1281 “Backup Withholding on Missing and Incorrect TINs.”

W4 EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

Employers are required to furnish W4 Certificates to all new employees. This form incorporates IRS instructions to employees for filing exemption allowances.

3921 EXERCISE OF STOCK FORMS

Every corporation which in any calendar year transfers to any employee a share of stock pursuant to that employee’s exercise on an incentive stock option described in section

422(b) must, for that calendar year, file Form 3921 for each transfer made during the year.

3922 TRANSFER OF STOCK FORMS

Every corporation which in any calendar year records, or has by its agent recorded, a transfer of the legal title of a share of stock acquired by the employee pursuant to the employee’s exercise of an option granted under an employee stock purchase plan and described in section 423(c) (where the exercise price is less than 100% of the value of the stock on the date of grant, or is not fixed or determinable on the date of grant), must, for that calendar year, file Form 3922 for each transfer made during the year.

I-9 EMPLOYMENT ELIGIBILITY VERIFICATION

The Department of Homeland Security: Requires employers to use this form to document that each new employee (both citizens and noncitizens) hired after November 6, 1986, is authorized to work in the United States. This form must be completed no later than the time of hire, which is the actual beginning of employment. Both employer and employee are required to fill in information to complete an I-9 form.

W9 PAYER’S REQUEST FOR TAXPAYER IDENTIFICATION NUMBER

Form W9 is used by payers required to file information returns (for example – income paid, real estate transactions, mortgage interest, acquisition or abandonment of secured property, cancellation of debt, or contributions made to an IRA) with the IRS to get the payee’s correct Taxpayer Identification Number (TIN). Payees use Form W9 to give their correct TIN to the person requesting it and, when applicable to:

1. Certify the TIN given is correct,

2. Certify payee is not subject to backup withholding, or

3. Claim exemption from backup withholding. For more information on backup withholding and requirements, obtain IRS Pub. 1679 “A Guide to Backup Withholding,” or Pub. 1281 “Backup Withholding on Missing and Incorrect TINs.”

W4 EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

Employers are required to furnish W4 Certificates to all new employees. This form incorporates IRS instructions to employees for filing exemption allowances.

3921 EXERCISE OF STOCK FORMS

Every corporation which in any calendar year transfers to any employee a share of stock pursuant to that employee’s exercise on an incentive stock option described in section

422(b) must, for that calendar year, file Form 3921 for each transfer made during the year.

3922 TRANSFER OF STOCK FORMS

Every corporation which in any calendar year records, or has by its agent recorded, a transfer of the legal title of a share of stock acquired by the employee pursuant to the employee’s exercise of an option granted under an employee stock purchase plan and described in section 423(c) (where the exercise price is less than 100% of the value of the stock on the date of grant, or is not fixed or determinable on the date of grant), must, for that calendar year, file Form 3922 for each transfer made during the year.

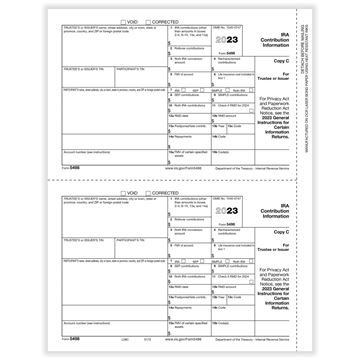

5498IRA CONTRIBUTION STATE/TRUSTEE OR ISSUER COPY C CUT SHEET/1000 per CTN

Ordering Unit: 1000/CTN

- $25.40

LASER 1094C TRANSMITTAL OF EMP'R PROVIDED HLTH INS OFFER & COV. FOR 1095C 3 PGS. BULK/500 per CTN

Ordering Unit: 500/CTN

- $63.47

LASER 1094C TRANSMITTAL OF EMP'R PROVIDED HLTH INS OFFER & COV. - 100/PACK

Ordering Unit: 100/Pack

- $3.52